Real Estate Bubbles: Evidence & Speculation

Two days ago, Howard's best girl sent him this link from Money Magazine and CNN that Fort Collins, Colorado is one of the Top 10 places in America right now to buy property. Then she sent him a follow-up link stating that in Greeley and Denver -- both cities less than an hour away from Fort Collins and on the Money/CNN Top 10 list of Foreclosure Markets -- houses there are not selling at all, sending homeowners into bankruptcy. Greeley is #1 worst in the nation, with Denver at #6. Not a good Top 10 list to be on.

But does this contrasting news from neighboring economies sound strange? We're not done yet.

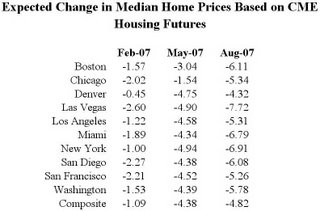

Then this morning, Second Son sent his dad a nice chart showing that futures traders are betting that Denver's real estate market will continue to drop, though not as badly as some other cities.

Then this morning, Second Son sent his dad a nice chart showing that futures traders are betting that Denver's real estate market will continue to drop, though not as badly as some other cities.He writes, "The Chicago Merc. trades housing futures for these different areas of the nation and Denver's one of them. Basically the stock market people are trying to make money off the housing collapse by betting on the overall trend of the housing prices. Anyhow, this shows that Denver will likely go down the least over the next 10 or so months."

So Money/CNN says that Fort Collins is one of the best places in the nation to buy property right now, while an hour down the highway, Greeley and Denver property isn't selling fast enough to keep them off the Top 10 list of foreclosures.

And Money/CNN says Denver's foreclosure rate is sixth worse in the country, while the futures traders in Chicago think Denver's not going to do as badly as, say, Las Vegas, Miami, and New York.

Except for the hard data on foreclosures, Howard thinks they're all guessing. In any case, it appears that everyone is thinking hard about a bursting real estate bubble. And that can't be good.

0 Comments:

Post a Comment

<< Home